5 Investment Principles for Physician Wealth Success

Since 1993, Physician Wealth Advisors (PWA) has helped Utah physician families meet their financial goals and protect their financial security by providing personalized financial education and advice. As salaried Certified Financial Planners®, our advisors work from a fiduciary standard and act in your best interest by providing financial planning, investment advice, and risk management from an independent perspective.

Below are five key principles we believe in and practice as we help physician families plan for and realize their long-term financial goals.

- Invest in Capital Markets

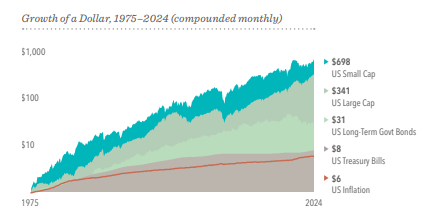

The financial markets have rewarded long-term investors. Physicians and other investors expect a positive return on the capital they supply, and the stock and bond markets have provided growth in wealth that has more than offset inflation over the past 50 years, as this chart shows.

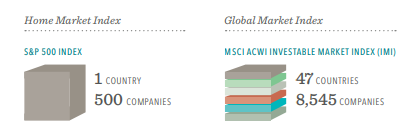

- Diversify Internationally

Holding a globally diversified portfolio can broaden your opportunities beyond your home market— putting you in a better position to capture higher returns wherever they appear.

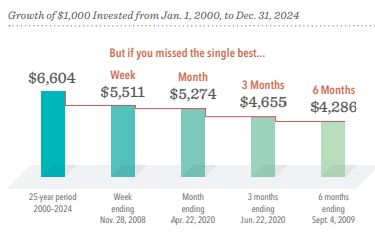

- Avoid Market Timing

Research has shown there’s no reliable way to time the market—targeting the best days to be invested or moving to the sidelines to avoid the worst days. It has also shown the impact of being out of the market even for a short time. Staying invested helps ensure you’re in position to capture long-term gains.

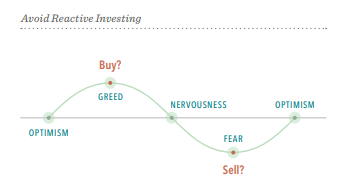

- Manage Your Emotions

When markets go up and down, many people struggle to separate their emotions from investing. Reacting to current market conditions may lead to poor investment decisions. Daily market news and commentary can also challenge your investment discipline. Some messages stir anxiety about the future, while others tempt you to chase the latest investment fad. We have learned that when headlines unsettle you as an investor, do yourself a favor and tune out the noise.

- Control What You Can Control

Partner with your financial advisor to stay focused on actions that add value. While you can’t control which way the market will turn, following time-tested principles can lead to a better investment experience.

- Create an investment plan to fit your needs and risk tolerance.

- Structure a portfolio along the dimensions of expected returns.

- Diversify globally.

- Manage expenses, turnover, and taxes.

- Stay disciplined through the market’s highs and lows.

Chart sources: Dimensional Fund Advisors; June 6, 2025, as of December 31, 2024.

Past performance is no guarantee of future results. Indices are not available for direct investment. Index performance does not reflect the expenses associated with the management of an actual portfolio. Diversification does not eliminate the risk of market loss. There is no guarantee that investment strategies will be successful. This information is for illustrative purposes only.

Mark Woodruff is a Certified Financial Planner® and Vice President with Physician Wealth Advisors (a wholly owned subsidiary of the Utah Medical Association). The salaried advisors at Physician Wealth Advisors (PWA) have been working with physician members of the UMA for over 32 years. Their expertise in creating customized retirement plans as well as tailored investment strategies. If you would like to see what Physician Wealth Advisors can do for you, call 801-747-0800 and schedule your complimentary financial consultation today.