The Value of Expertise

One of the key characteristics of an expert is the ability to process information to make the best decision possible about the situation at hand. For example, someone might describe troubling symptoms to a doctor simply as chest pain, but a trained physician will be able to ask questions and test several hypotheses before arriving at any conclusions.

There are striking parallels between the work of a physician and the work of an experienced financial advisor. While many individuals may have the capacity to achieve a high level of understanding within a given field, reaching this point takes time, dedication, and experience. In the New York Times best-selling book “Outliers”, Malcolm Gladwell explains that reaching the 10,000-hour threshold is a critical component of expertise in any field. The consultative nature of a relationship with a financial advisor who has this level of experience—both when a situation arises and as we progress through life—is one of the key benefits that an expert can provide.

The responsibility of an advisor is to understand the needs, goals and objectives of their client so that they can fully assess their situation, then develop a treatment plan. Starting a relationship with a well-thought-out plan will help ensure that clients will be in the best position possible to meet their long-term financial goals and will also form the basis for future behavioral coaching conversations. Once the plan is underway, the advisor monitors the client’s situation, evaluates if the course of action remains appropriate, and helps the client to maintain the discipline required for the plan to work as intended.

Advisors often experience conversations with clients who are triggered by sensationalized news reports or informed by unqualified sources. Such sources might suggest that if they’re not making changes to their investments, they’re doing something wrong. Advisors understand that market headlines change far more often than do investors’ objectives. There is probably no harm done when a person, recognizing the onset of a common cold, takes cold medicine, drinks plenty of fluids, and rests. However, without the presence of an expert to collaborate with, if an individual self-diagnoses and self-medicates, it may cause serious harm.

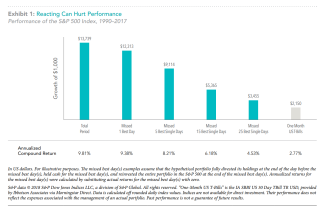

Research shows that the most significant pitfalls of investing are the temptation to chase performance and the allure of market timing. Abandoning a planned investment strategy can be costly since there is no reliable way to forecast when positive returns in equity markets will occur.1 Very few predicted that January would be the best start to the year for the stock market in over 30 years, following the worst December since 1931. One might think that missing just a few days of strong returns would not make much difference over the long term. On the contrary, as illustrated in Exhibit 1, had an investor missed the 25 single best days in the S&P 500, between 1990 and the end of 2017, their annualized return would have dropped from 9.8% to 4.5%. Such an outcome can have a major impact on achieving an investor’s financial goals

Improving someone’s financial health is a lot like improving their physical health. The challenges associated with pursuing a better financial outcome include diagnosis of the current situation, development of the appropriate course of action, and sticking with the treatment plan. The benefits of working with a financial expert are demonstrated through the ability to both help clients pursue their financial goals and to provide a positive experience along the way. By creating a long-term financial plan and providing the prescription of reassurance and education over time, we believe the proper financial guidance can play an irreplaceable role in investors’ lives.